irs tax levy calculator

Calculate the employees gross pay for the pay period. The IRS can take as much as 70 of.

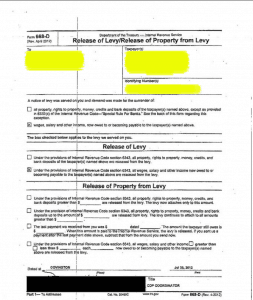

What Is A Levy How To Get It Released Tax Debt Advisors

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

. For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments. Gross pay is income before deductions. If you have a tax debt the irs can issue a levy.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can. We help clients with IRS levies and other collection matters. A levy is a legal seizure of your property to satisfy a tax debt.

Levies are different from liens. I have an employee who has a 2100 tax levy as of 032007s notice. Once you have found the correct table find your payroll frequency in the first column and read across to the column for the number of allowances the employee claims on.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related. I have an employee who has a 2100 tax levy as of 032007s notice. Instruct the employee to sign and return the Statement of Exemptions and Filing Status and return parts 3 and 4 to the.

Interest and any applicable penalties will continue to accrue after. You will need a copy of all. Enter gross amount paid to employee 3.

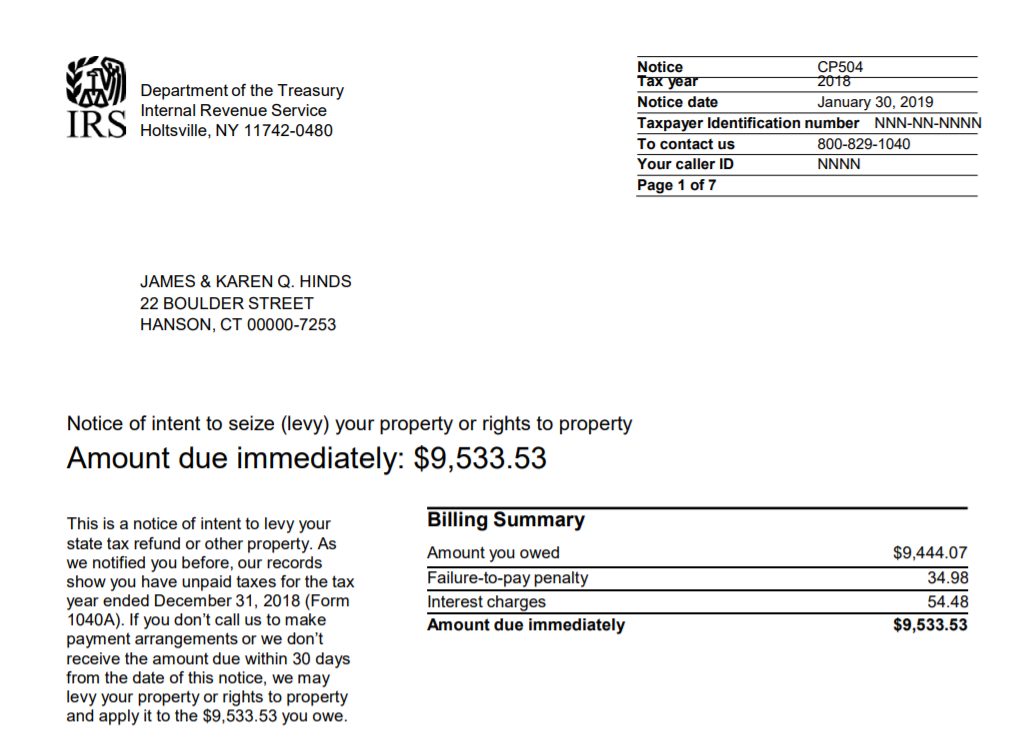

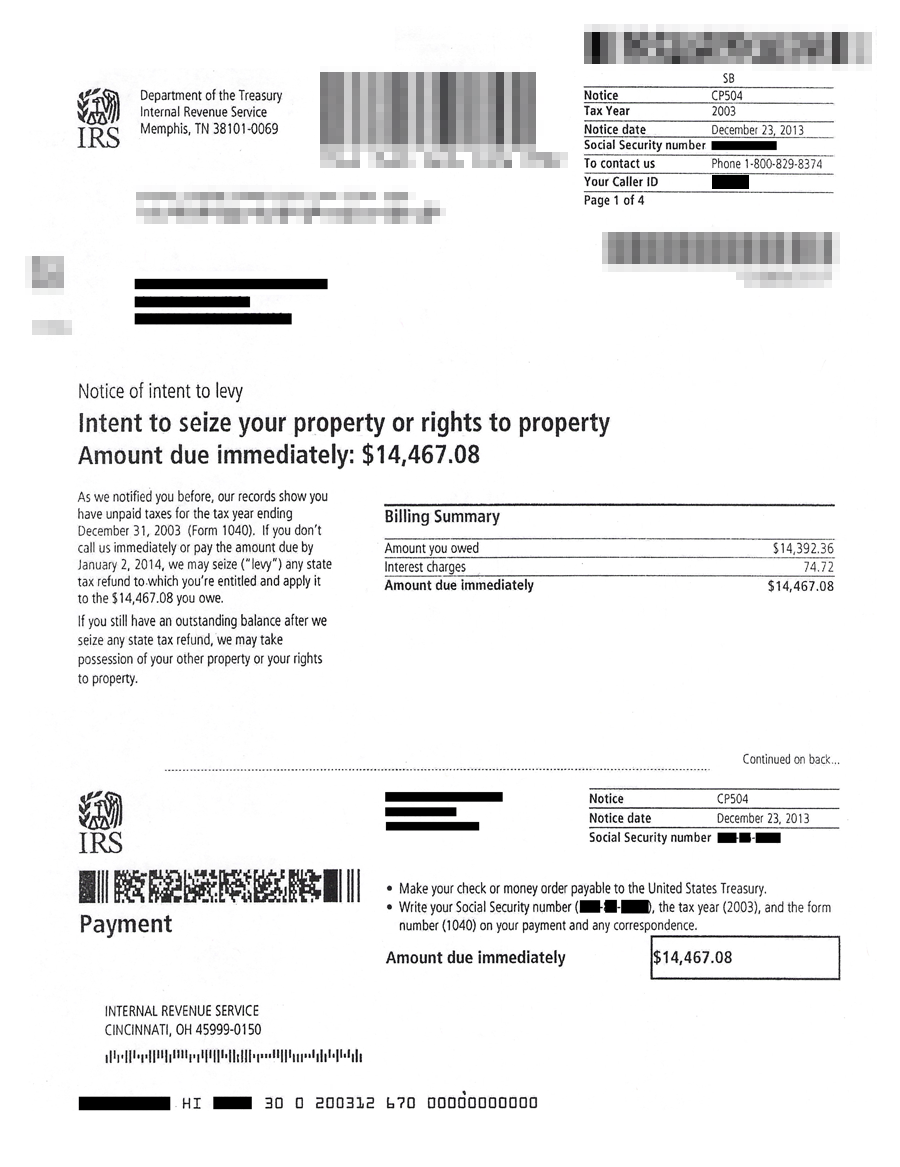

IRS tax forms. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

Under this program the IRS can generally take up to 15 percent of your federal payments including Social Security or up to 100 percent of payments due to a vendor for. We are experienced tax attorneys in Houston Texas. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck.

This includes helping clients get levy releases. Help With an IRS Tax Levy. The exempt amount is based on the standard deduction and an amount determined calculated in part based on the number of dependents you are allowed for the year the levy is served.

By using this site you agree to the use of cookies. Immediately give the employee parts 2 3 4 and 5 of the wage levy. For employees withholding is the amount of federal income tax withheld from your paycheck.

Irs tax levy calculator. Deduct payroll taxes such as federal income tax Social Security tax Medicare tax and. Levy forms include a Total Amount Due This amount is calculated through the date shown below the total amount due.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. File your tax return on time. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes.

A tax levy is a. Pay Period Frequency select one 2. Federal income tax b.

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD.

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

2021 Estate Income Tax Calculator Rates

Irs Levy Fears Can Be Overstated Washington Tax Services

What Is Irs Wage Garnishment Understanding The Process Of Levying Wages

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

5 17 2 Federal Tax Liens Internal Revenue Service

Need Help With An Irs Levy Baltimore Owings Mills Maryland

Federal Tax Reform Slashed Corporate Taxes But Some State Levies Bump Business Rates Back Up Don T Mess With Taxes

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding The Economic Effects Of Federal Tax Changes Equitable Growth

Wage Levies The Irs Is Taking My Paycheck Private Tax Solutions

How Do State And Local Property Taxes Work Tax Policy Center

Irs And State Bank Levy Information Larson Tax Relief

Irs Audit Letter Cp504b Sample 1

State And Irs Tax Relief Attorney Pittsburgh Pa Taxlane